Sunday, March 15, 2009

Jon Stewart vs Jim Cramer

The interview has had a huge fan faollowing in the US. The Washington Post reports White House Press Secretary Robert Gibbs saying "I Enjoyed It Thoroughly", when asked about the show.

When the equity markets were in a bullish phase, CNBC's Indian unit - CNBC TV18, made the mistake of celebrating (literally) every additional 1000 points on the Bombay Stock Exchange, knowing very well that the market was frothy. The reporters wore colorful dresses, cut cakes and decorated the studio with balloons! Why did they do all that? The TV channel has a stake in the market going up all the time and small investors feeling gung-ho about it. So it was just an act of playing to the gallery. One wondered whether CNBC TV18 is a business news channel or an entertainment channel.....

Watch Jon Stewart's interview here:

I hope shows like this highlight and encourage debate on the important issue of an inherent conflict of interest that the news media faces these days - the quest for profit versus the duty of quality reporting and investigative journalism. If the issue of conflict of interest is not resolved, news media risks failing in its role as a pillar of democracy.

Friday, March 13, 2009

Monday, March 9, 2009

Black Swan Fund gains 236% amidst capitulation in financial markets

How did 36 South manage to put up such an impressive performance? It has to do with the trading strategy. 36 South buys long-dated options it considers cheap - in currency, bond, equity and commodity markets, betting that rare and unforeseen events would generate unusually large profits. The premium it pays on those options are relatively small - but when the direction of the bet is right, the pay-off is huge.

36 South had profited from bets on interest-rate cuts in Australia and New Zealand, and the purchase of put options on major stocks around the world, including BRIC nations. The fund had also bought put options on commodities.

The risk premium on most of the financial instruments has risen significantly over the last few months, making such a trade not so lucrative these days. Volatility indices have risen substantially and consequently the options premia have shot up. So, a trade similar to what 36 South entered into last year, is unlikely to be lucrative this year.

What is 36 South going to do next? It will start a fund that will bet on inflation around the world going up significantly. With governments around the world planning to tackle recession by printing money and pumping it into their economies, 36 South is likely to make a killing once again.

Friday, November 21, 2008

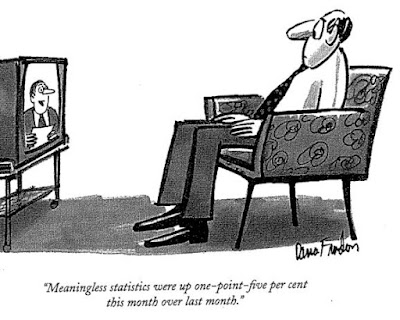

The funny side of capitalism

The first one is an article by Jonathan Weil, a Bloomberg columnist.

Weil talks about GM's 2033 bonds, whose prices indicate that the market is betting GM will go down under in the next 2 years, even with a government subsidy. The article argues that in the current market, knowing government's plans is the only way to make money. If one doesn't then there is a very good possibility of losing money, irrespective of whether you are long or short.

This does not come as a surprise to people who follow the Indian markets. The Indian finance minister has many times reversed market sentiment just by calling a press conference!

The other is a post on a blog, in which one of the commenters had combined the news on Somali pirates with the news of Citigroup shares tumbling 46% in two days, to come up with this masterpiece:

The Somali pirates, renegade Somalis known for hijacking ships for ransom in the Gulf of Aden, are negotiating a purchase of Citigroup. The pirates would buy Citigroup with new debt and their existing cash stockpiles, earned most recently from hijacking numerous ships, including most recently a $200 million Saudi Arabian oil tanker. The Somali pirates are offering up to $0.10 per share for Citigroup, pirate spokesman Sugule Ali said earlier today. The negotiations have entered the final stage, Ali said. ``You may not like our price, but we are not in the business of paying for things. Be happy we are in the mood to offer the shareholders anything," said Ali.

The pirates will finance part of the purchase by selling new Pirate Ransom Backed Securities. The PRBS's are backed by the cash flows from future ransom payments from hijackings in the Gulf of Aden. Moody's and S&P have already issued their top investment grade ratings for the PRBS's. Head pirate, Ubu Kalid Shandu, said "we need a bank so that we have a place to keep all of our ransom money. Thankfully, the dislocations in the capital markets has allowed us to purchase Citigroup at an attractive valuation and to take advantage of TARP capital to grow the business even faster."

Shandu added, "We don't call ourselves pirates. We are coastguards and this will just allow us to guard our coasts better."

Tuesday, November 18, 2008

Credit Default Swaps in India?

In my post of April 8, 2007, I had argued about the need to enhance liquidity in the debt market. Credit derivatives are essential tools to mitigate risk and the introduction of the derivatives is a step in the right direction. However, introducing CDS alone will not be enough - credit derivatives market cannot be moved onshore unless India moves steadily towards full capital account convertibility.

Some people argue that India should never allow full capital account convertibility. In their defence, they cite the example of how some of the East Asian countries were battered during the crisis of 1997. The article by Easwar Prasad and Raghuram Rajan (link) offers a balanced perspective.

Tuesday, November 11, 2008

China's $600 bn stimulus package

We could not have been more prescient. The Chinese government has now declared a huge stimulus plan worth nearly USD 600 billion over the next 2 to 3 years on infrastructure build up. As always with China, there is not much information available on how the stimulus package will work and what part of it is in addition to the projects announced already.

There is no doubt that such a massive capex plan will ensure that demand in many basic industries do not fall off a cliff. However, one needs to guard against the build-up of non-productive assets, for which China is well-known.

The stock markets greeted the move with a big rally, but it will not be long before the rally peters out!

Saturday, October 25, 2008

'I made a mistake' admits Greenspan

Greenspan is viewed by many as an oracle-type personality, but I have had misgivings against him (against the Fed (of which he was chairman), to be precise) for the following reason:

During the 18 year period when Greenspan was at the helm, whenever a crisis arose, the Fed came to rescue by significantly lowering the Fed Funds rate, often resulting in a negative real yield. The Fed did so after the 1987 stock market crash, the LTCM debacle, and the Nasdaq bubble burst. The Fed's pattern of providing ample liquidity resulted in the investor perception of put protection on asset prices. The result - every time the Fed put was in action, the bubbles just shifted from one asset class to another and kept becoming bigger. I had warned that the Fed's action of cutting interest rates in 2007 would not solve the issue, but would just postpone it and in the process create additional bubbles. I was right - Fed's action did create a bubble in commodities and emerging market equities. These bubbles have burst now, creating havoc in the process.

Coming back to Greenspan, I am happy that he has now admitted that unbridled deregulation is bad for the markets. I agree that capitalism is good - it is indeed our best hope to create equitable and sustainable development and prosperity. However, capitalism needs to have conscience. Recent event prove that markets are incapable of self regulation.

Many people believe that it is not the job of the central bank to identify and deflate asset bubbles – I beg to differ. When asset bubbles get created and finally burst, they cause heavy damage to sections of the populace which had no role to play in creating the bubble. The recent financial meltdown shows very clearly that it is not just the speculators who get affected – crises do have an effect on the economy, on jobs, and on the livelihood of poor families.

Some people do argue that central banks do have very limited tools. The plight of the Reserve Bank of India (RBI) in managing the relentless capital inflows into the Indian equity and real estate markets last year is a case in point. The RBI had to soak up USD from the market, releasing Indian currency. This increased liquidity in the system and also pushed inflation upwards. To flight inflation, RBI had to increase benchmark interest rates – the increase in interest rates increased the interest rate differential and led to even higher dollar inflows. It was a vicious cycle.

The world has become so complex that unless there is coordinated action from most of the central banks, it will be difficult to craft an effective response. Many people think China should let its currency appreciate faster. Try telling that to Chinese authorities who need to ensure 10% GDP growth to keep the political system stable!

Monday, October 20, 2008

Funny metaphors

1. This is a dead cat bounce

2. The stock markets took of like a rocket and then nosedived like a failed rocket

3. We all learnt in school what goes up must come down

This is my favorite: “The train has left the station. There is no point in getting off now”

Sunday, October 19, 2008

Emerging market OR Submerging market? Ask FIIs

The Economic Times, the most widely read Indian business daily, carried an interesting article:

“Foreign institutional investors (FIIs) have played a major role in pushing up the index and pulling it down, hurting themselves in the process.

During the ride of the sensex from 10,082 points on February 7, 2006 to 20,582 points on January 10, 2008, FIIs had made a net purchase worth Rs 1,00,951 crore (close to 22 billion USD). During this period, the FIIs provided the required liquidity and the cues for others to follow.

FIIs' net off-loading was to the tune of Rs 47,299 crore (close to 11 billion USD), dragging down the sensex from 20,582 points to 9,975 points”

This clearly shows that FIIs could not make a clean and complete exit and have, along with Indian investors, burnt their fingers getting carried away by the euphoria caused by the Fed’s slashing of benchmark rate in September 2007.

Saturday, October 18, 2008

Where is the global economy headed?

There is so much panic, skepticism, and fear among not just investors but also laymen who are wondering whether they will get to keep their jobs, be able to feed their families and pay their mortgage. The scenario is so anti to how it has been over the last few years when words like optimism, confidence and euphoria defined the mood.

Not everyone has realized yet that the turmoil in credit markets will affect the real economy. The freeze in credit markets is bound to have a ripple effect on economic activity. People must be naïve if they think the credit crisis would affect only the financial markets. The crisis would push CEOs make preserving cash the objective, rather than chasing growth. Jeffrey Immelt, the Chairman & CEO of GE recently commented (not quoting him verbatim here) "for every dollar of economic activity, there is 10 dollars of financing involved in the entire supply chain. So if credit market freezes, economic output is bound to be affected."

Now back to the question - Where is the global economy headed?

A recent Reuters poll of economists showed that “the global economy will likely shudder to recessionary levels in 2009 as developed nations' woes damage emerging countries' economic prospects”. The IMF has also projected sharply lower growth for 2009. My take is that we should consider ourselves lucky if we can escape a deep and prolonged recession.

One bright spot in the economy right now is the fall in commodity prices. Oil prices have fallen 50% from the peak and prices of industrial commodities have crashed as well. Oil prices are likely to remain soft if OPEC does not become too greedy. Lower commodity prices will ease the pain many economies are facing.

Monday, October 13, 2008

Manic Markets

Thursday, August 14, 2008

Greenspan does it again

NEW YORK (CNNMoney.com) -- Alan Greenspan, former chairman of the Federal Reserve, projects that housing prices could bottom out in 2009 - or maybe later - according to a news report.

"Home prices in the U.S. are likely to start to stabilize or touch bottom sometime in the first half of 2009, " said Greenspan to The Wall Street Journal.

But he also added that "prices could continue to drift lower through 2009 and beyond," according to the newspaper.

In my post dated 17th March 2008, this is what I had to say

The US Fed is blamed by many for taking no action to prvent the crisis. It is interesting to read the comments of Alan Greenspan, the former Fed Chairman, as gathered by Paul Krugman, a columnist with the New York Times

What Greenspan said: “The current financial crisis in the US is likely to be judged in retrospect as the most wrenching since the end of the second world war. It will end eventually when home prices stabilise and with them the value of equity in homes supporting troubled mortgage securities.Home price stabilisation will restore much-needed clarity to the marketplace because losses will be realised rather than prospective. The major source of contagion will be removed. Financial institutions will then recapitalise or go out of business. Trust in the solvency of remaining counterparties will be gradually restored and issuance of loans and securities will slowly return to normal.”

What Keynes said: In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.

Thursday, May 1, 2008

‘Decoupling is inherently illogical’

The Governor of the Reserve Bank of India (India's Central Bank) commented that "the Decoupling theory is inherently illogical". He adds, "decoupling is a theory which is contextually convenient but inherently illogical. The general analysis now is that it may not be decoupling but a divergence in terms of effect. Hence, you will find that the impact on growth is large in advanced economies while emerging markets escape with softer impact. So there is a differential impact on EMEs and among EMEs. But directionally everybody would have an impact".

I would imagine that directionally, emerging countries would see more people joining the "consuming class" driving up demand for food, energy, and industrial goods. Despite the short term excesses in the real estate markets, one can definitely expect the urbanisation process to continue and maintain an upward bias on real estate prices.

Monday, March 17, 2008

The demise of Bear Stearns

Bear Stearns has been absorbed by JP Morgan for just $2 per share – reportedly valuing the company at $236 million. It has been a dramatic collapse of a Wall Street Firm that was the darling of employees and stock markets. The employees seem to own nearly 30% of the company (though a significant chunk is likely to be owned by the top few executives) and it has been a terrible loss of personal wealth for them.

I feel sorry for Bear Stearns employees and investors. But I think such incidents tend to make the market healthier by weeding out excesses.

It is apt to be a little philosophical at times like these. Incidents like these reinforce our belief in the laws of Systems Thinking and Behavioral Economics

a) In my post of 30th March 2007, I had discussed how the ballooning asset bubble was threatening to push the financial markets off a cliff and the events that are unfolding now were not so hard to predict even a year earlier.

b) Students of Game Theory know about “Prisoner’s Dilemma”. To cut a long story short, it says that every individual acts in his own interest, thereby causing systemic failures. This failure ends up harming the individuals’ interest which they thought they could protect by acting in a “selfish” manner. Run on banks follows the same principle. When everyone is in a hurry to withdraw their assets from a bank (to protect their own savings, and in hurry to withdraw the asset before the neighbor next door does so), the bank collapses. It does not require erosion in the value of assets of the bank to trigger a crisis like this – it requires just erosion in confidence in the bank.

c) “The law of unintended consequences” is playing catch up: The last few moves of the Fed have had quite a few undesirable effects. Excessive rate cuts by the US Fed have always created asset bubbles – Nasdaq, Subprime, and now a short lived bubble in emerging market equities. Despite the rate cuts, the mortgage crisis is only gathering pace and the economy does not seem to stop sinking into a recession.

The US Fed is blamed by many for taking no action to prvent the crisis. It is interesting to read the comments of Alan Greenspan, the former Fed Chairman, as gathered by Paul Krugman, a columnist with the New York Times

What Greenspan said: “The current financial crisis in the US is likely to be judged in retrospect as the most wrenching since the end of the second world war. It will end eventually when home prices stabilise and with them the value of equity in homes supporting troubled mortgage securities.

Home price stabilisation will restore much-needed clarity to the marketplace because losses will be realised rather than prospective. The major source of contagion will be removed. Financial institutions will then recapitalise or go out of business. Trust in the solvency of remaining counterparties will be gradually restored and issuance of loans and securities will slowly return to normal.”

What Keynes said: In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.

Thursday, March 13, 2008

Debunk the Decoupling Theory Atleast Now

My comments on January 20th (read post on this link) have all come true !!!

Just a day after I posted the comment, the Indian stock market fell 10% on an intraday basis. The next day it fell another 14% on an intraday basis. Though stock markets recovered a bit, they have been on a down-trend ever since.

It takes a brave man to voice opinion against the wisdom of the crowds and the events over the last few weeks make me feel vindicated.

What were those predictions and how have they markets shaped up against these predictions ?

a) During a downturn, money flows into the home market

There have been huge outflows from emerging markets. Indian and Chinese stock markets have been the worst performers this year.

b) If there is a recession in the US, no country can fully decouple itself and maintain its growth rate

There are signs of sluggishness in the Indian economy. Reports indicate that India’s Industrial Production grew by only 5.3% in January. Bank of China estimates Chinese GDP growth to slow down. Decoupling theory has now given way to Recoupling theory !!!

c) Reckless rate cuts will only stoke inflation rather providing a real impetus to growth (China is currently witnessing inflation of over 6% and the authorities have committed themselves to fight it through a tight monetary policy). Despite the heavy fall in short term interest rates in the US, the long term interest rates have refused to budge, indicating bullishness on inflation trends.

Just look at Gold and Oil. Gold has reached $1000 and oil has crossed $110 – close to a 100% gain in the last 12 months.

How do you position yourself ?

a) Act like a hedge fund; have a long-and short strategy. Immediately switch out of stocks that are dependent on discretionary consumer spending in the US. You can buy into emerging market equities on dips, but buy into those stocks which have lower export component and are fairly valued. Don’t buy stocks whose valuations are can be justified only by a great growth story.

The Indian and Chinese markets have fallen 25% from the peak and people who bought into “growth stocks” have burnt their fingers very badly.

b) If you play commodities, play agri-commodities – the switch from food to fuel is unlikely reverse in a hurry and will help maintain an upward bias on prices.

Soybean, Corn, and Wheat futures have gained around 25 percent from the time I posted the message two months back.

c) If you are currency trader, short the dollar and the pound and go long on the Chinese Yuan. The Chinese government is not answerable to its people and will not mind paying the cost of holding a huge forex reserve (the reserve is already worth about $1.6 trillion – over 50% of its GDP). The government is in NO mood to let the currency seek its natural level and China's trade surplus is not going to disappear in a hurry

Dollar is at an all time low versus a basket of currencies and the Yuan has gained further ground against the dollar. A short position on the dollar and long position on the yuan would have given handsome rewards.