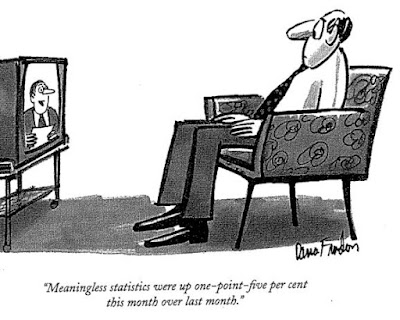

Jon Stewart, host of The Daily Show, recently interviewed Jim Cramer, the host of CNBC's Mad Money. Jon takes a dig at the business news channels that failed to educate viewers on what was happening in the financial markets and Cramer is defenseless.

The interview has had a huge fan faollowing in the US. The Washington Post reports White House Press Secretary Robert Gibbs saying "I Enjoyed It Thoroughly", when asked about the show.

When the equity markets were in a bullish phase, CNBC's Indian unit - CNBC TV18, made the mistake of celebrating (literally) every additional 1000 points on the Bombay Stock Exchange, knowing very well that the market was frothy. The reporters wore colorful dresses, cut cakes and decorated the studio with balloons! Why did they do all that? The TV channel has a stake in the market going up all the time and small investors feeling gung-ho about it. So it was just an act of playing to the gallery. One wondered whether CNBC TV18 is a business news channel or an entertainment channel.....

Watch Jon Stewart's interview here:

I hope shows like this highlight and encourage debate on the important issue of an inherent conflict of interest that the news media faces these days - the quest for profit versus the duty of quality reporting and investigative journalism. If the issue of conflict of interest is not resolved, news media risks failing in its role as a pillar of democracy.

Sunday, March 15, 2009

Friday, March 13, 2009

Monday, March 9, 2009

Black Swan Fund gains 236% amidst capitulation in financial markets

Bloomberg reports that 36 South Investment Managers, a New Zealand based hedge fund, gained 236% in the last 12 months. This is a terrific record in a year where hedge funds lost 19% on an average.

How did 36 South manage to put up such an impressive performance? It has to do with the trading strategy. 36 South buys long-dated options it considers cheap - in currency, bond, equity and commodity markets, betting that rare and unforeseen events would generate unusually large profits. The premium it pays on those options are relatively small - but when the direction of the bet is right, the pay-off is huge.

36 South had profited from bets on interest-rate cuts in Australia and New Zealand, and the purchase of put options on major stocks around the world, including BRIC nations. The fund had also bought put options on commodities.

The risk premium on most of the financial instruments has risen significantly over the last few months, making such a trade not so lucrative these days. Volatility indices have risen substantially and consequently the options premia have shot up. So, a trade similar to what 36 South entered into last year, is unlikely to be lucrative this year.

What is 36 South going to do next? It will start a fund that will bet on inflation around the world going up significantly. With governments around the world planning to tackle recession by printing money and pumping it into their economies, 36 South is likely to make a killing once again.

How did 36 South manage to put up such an impressive performance? It has to do with the trading strategy. 36 South buys long-dated options it considers cheap - in currency, bond, equity and commodity markets, betting that rare and unforeseen events would generate unusually large profits. The premium it pays on those options are relatively small - but when the direction of the bet is right, the pay-off is huge.

36 South had profited from bets on interest-rate cuts in Australia and New Zealand, and the purchase of put options on major stocks around the world, including BRIC nations. The fund had also bought put options on commodities.

The risk premium on most of the financial instruments has risen significantly over the last few months, making such a trade not so lucrative these days. Volatility indices have risen substantially and consequently the options premia have shot up. So, a trade similar to what 36 South entered into last year, is unlikely to be lucrative this year.

What is 36 South going to do next? It will start a fund that will bet on inflation around the world going up significantly. With governments around the world planning to tackle recession by printing money and pumping it into their economies, 36 South is likely to make a killing once again.

Subscribe to:

Comments (Atom)