Saturday, March 13, 2010

Was the Euro a mistake?

The Germans are wary - what signal would Greece’s bailout send to the other EU members who are facing similar problems? Would Portugal and Spain be next in line for a bailout?

Germany has been a big “paymaster” to the EU, contributing 60% of EU’s annual budget. Germany has gained significantly from the Euro. Almost half of German exports go countries in the euro-region – these countries have lost out because they can no longer devalue their currency to remain competitive. However, German taxpayers seem to be losing their patience – too many of their neighbors have rigid labor markets and little discipline when it comes to public spending.

I think the underlying issue is much bigger and more fundamental. The arguments in favor of the European Monetary Union were free trade, better labor mobility and enhanced competitiveness. However, many skeptics believed that a common currency made little economic sense. Economist Milton Friedman said in 2001 “As time went by, there would be serious differences in the EU over the policies the European Central Bank should follow”…. "You know, it's an ironic thing in a way," he said, "the euro was adopted really for political purposes, not economic purposes, as a step toward the myth of the United States of Europe. In fact I believe its effect will be exactly the opposite."

Friedman’s prognosis seems to be slowly coming true. By adopting the euro the member countries gave away their monetary policy freedom to the European Central Bank. This makes it extremely difficult for the member states to deal with asymmetric shocks and tailor monetary policies to suit local needs. Spain is a very good case in point. Spaniards could not use monetary policy tools to control the housing bubble – now the bubble has burst. Spain’s labor market has traditionally been too rigid, making it difficult for employers to hire and fire workers. Today Spain’s unemployment is at 20%. The construction boom of the last few years attracted so many workers from Eastern Europe who now stay put in Spain even during the economic downturn, making the unemployment problem in Spain much worse.

A country in the EU region can afford to lose its monetary policy and fiscal policy independence only when labor mobility within the EU region is near perfect (i.e. if unemployment increases in Spain, labor can move to France or Germany) and the potential for big local shocks get mitigated through a common regulations and fiscal policy. Both these conditions are difficult to meet! Labor mobility in the EU region will not be high because of language and cultural barriers. Common fiscal policy and common labor regulations are possible in the US because most of the policies are set by the Federal government but is very difficult to replicate in Europe.

So, is the euro a mistake? A common currency for the euro region appears premature, if not an outright mistake. The costs, at least to some countries, are much higher than the benefits.

Monday, January 4, 2010

Wrong Problem, Wrong Solution Mr. Krugman

I agree with Krugman on his comments so far, but Krugman also argues in favor of protectionism and "trade confrontation" by the developed world to get China to revalue the yuan.

I think there are a couple of flaws in Krugman's argument:

a) Currency is not the only factor which makes China competitive. Speak to companies that import stuff from China - they would tell you that currency is important, but one cannot ignore factors like labor availability, infrastructure and to some extent regulatory (health / safety / working conditions / minimum wages etc) arbitrage which makes China’s manufacturing competitive.

b) Krugman, through his "back-of-the-envelope calculation", has pegged the extent of job loss in the US because of China's currency policy at 1.4 million. I think Krugman has overestimated the ability of the US and other countries to competitively manufacture most of the goods that are currently imported from China. What might happen with yuan appreciation is just a rise in inflation and inflationary expectations in the world and not job creation. At a time when unemployment is high and economies are growing at a slow pace, high inflation can cause a lot of trouble.

c) Protectionism and trade confrontation are easy to recommend but extremely difficult to implement. I had argued in my earlier post that under WTO rules it would be difficult to force China to revalue its currency. The only way out would be to bypass the WTO and erect trade barriers against China. However, the US and the EU will be shooting themselves in their foot if they undermine the WTO.

This takes us back to the question - How should the US and EU deal with Chinese currency "manipulation"?.... My answer is still the same - China 's currency policy is clearly unsustainable and market forces will eventually force China to revalue its currency. The developed world should leave the timing of yuan revaluation to market forces.

Friday, December 25, 2009

Dealing with "manipulation" of the yuan

China has had a significant trade surplus over the last many years (over $800 billion in just the last four years). China's trade surplus peaked last year at around 9% of GDP. In 2009, it is expected to be around 5% of GDP. China's huge trade surplus and its rising economic power has increased pressure on elected officials in the US and EU to act on China's "currency manipulation". Chinese premier Wen Jiabao rejected the calls for currency revaluation as "unfair". "Their measures are restricting China's development" Wen Jiabao said.

There is no evidence that revaluing the yuan will have a positive effect on the unemployment statistics in the developed world. Former Federal Reserve Chairman Alan Greenspan mentioned in 2005 - "I am aware of no credible evidence that ... a marked increase in the exchange value of the Chinese [yuan] relative to the dollar would significantly increase manufacturing activity and jobs in the United States." I agree with Greenspan. There is not much of an overlap between the exports of China and the US and EU. If China revalues its currency, the US and EU imports will move from China to some other country (say India or Taiwan or Vietnam) or increase inflation in the developed world instead of creating jobs in the developed world.

Even if we assume that there is a correlation between Chinese currency appreciation and jobs in the developed world, the US and EU cannot do much. The WTO does not have too many rules against currency manipulation. There is no consensus that the China's pegging of yuan to the US dollar (which many people think is currency manipulation) would qualify as a "subsidy" under the WTO treaty. Hence it would be difficult to force China to revalue its currency under WTO rules.

Market forces will eventually force China to revalue its currency (when it revalues is anybody's guess). Today, People's Bank of China keeps its currency artificially low by absorbing dollars from the market and investing them in US Treasuries. This increases yuan in circulation, increasing inflation in the process. The central bank has to then remove these additional currency in circulation by issung bonds (at an interest rate much higher then the interest rate on US treasury securities). The cost of doing this is very high - the interest rate differential of around 5% would amount to over a $100 billion per annum on a $2 trillion reserve! This process of running huge trade surpluses and accumulating reserves will become increasingly unsustainable.

Bottomline - there is neither a need nor a way to force China to appreciate the yuan. Sit tight and leave yuan revaluation to market forces.

Tuesday, April 7, 2009

It's the deleveraging process stupid

I read an impressive article on Bridgewater Associates (the world's biggest hedge fund) and its CEO Ray Dalio, in the Fortune magazine. His flagship fund has clocked an annual return of 15% over the last 18 years – a very impressive performance indeed. The fund never imploded during the many crises the financial markets have seen over the last two decades. Also, when 70% of the hedge funds lost money last year and the average hedge fund was down 18%, Dalio's fund returned an impressive 14%.

The article claims that over the last two years, the hedge fund industry in aggregate terms has been closely correlated to the S&P 500 and had even reached a 75% correlation. I am not able to digest the fact that hedge funds had such a big bias towards growth even though signs of strain in the economy had begun to surface 2 years ago.

I liked the way Dalio put the current economic woes in perspective:

“Most people think that a depression is simply a really, really bad recession. But in reality, the two are distinct, naturally occurring events. A recession is a contraction in real GDP brought on by a central bank tightening monetary policy, usually to control inflation, and ends when the central bank eases. But a D-process (deleveraging process) occurs when an economy has an unsustainably high debt burden and monetary policy ceases to be effective, usually because interest rates are close to zero, and the central bank has no way to stimulate the economy. To compensate, the value of debt must be written down (risking deflation) or the central bank must print money (a trigger of inflation), or some combination of both.” In recent years the level of debt as a percentage of GDP in the U.S. has skyrocketed past previous highs last seen in the early 1930s. And the Federal Reserve's benchmark rate is now hovering just above zero. "It seems very likely that stocks will get materially cheaper," he says. "We have to go through an important debt restructuring process, and a lot of assets are going to be for sale, huge numbers of assets. And there's going to be a shortage of buyers."

If Dalio’s predictions come true, the expectation that the markets have bottomed out could be short-lived.

Sunday, March 15, 2009

Jon Stewart vs Jim Cramer

The interview has had a huge fan faollowing in the US. The Washington Post reports White House Press Secretary Robert Gibbs saying "I Enjoyed It Thoroughly", when asked about the show.

When the equity markets were in a bullish phase, CNBC's Indian unit - CNBC TV18, made the mistake of celebrating (literally) every additional 1000 points on the Bombay Stock Exchange, knowing very well that the market was frothy. The reporters wore colorful dresses, cut cakes and decorated the studio with balloons! Why did they do all that? The TV channel has a stake in the market going up all the time and small investors feeling gung-ho about it. So it was just an act of playing to the gallery. One wondered whether CNBC TV18 is a business news channel or an entertainment channel.....

Watch Jon Stewart's interview here:

I hope shows like this highlight and encourage debate on the important issue of an inherent conflict of interest that the news media faces these days - the quest for profit versus the duty of quality reporting and investigative journalism. If the issue of conflict of interest is not resolved, news media risks failing in its role as a pillar of democracy.

Friday, March 13, 2009

Monday, March 9, 2009

Black Swan Fund gains 236% amidst capitulation in financial markets

How did 36 South manage to put up such an impressive performance? It has to do with the trading strategy. 36 South buys long-dated options it considers cheap - in currency, bond, equity and commodity markets, betting that rare and unforeseen events would generate unusually large profits. The premium it pays on those options are relatively small - but when the direction of the bet is right, the pay-off is huge.

36 South had profited from bets on interest-rate cuts in Australia and New Zealand, and the purchase of put options on major stocks around the world, including BRIC nations. The fund had also bought put options on commodities.

The risk premium on most of the financial instruments has risen significantly over the last few months, making such a trade not so lucrative these days. Volatility indices have risen substantially and consequently the options premia have shot up. So, a trade similar to what 36 South entered into last year, is unlikely to be lucrative this year.

What is 36 South going to do next? It will start a fund that will bet on inflation around the world going up significantly. With governments around the world planning to tackle recession by printing money and pumping it into their economies, 36 South is likely to make a killing once again.

Friday, November 21, 2008

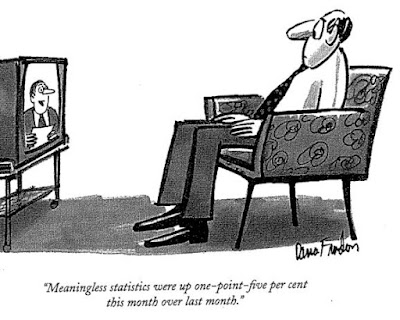

The funny side of capitalism

The first one is an article by Jonathan Weil, a Bloomberg columnist.

Weil talks about GM's 2033 bonds, whose prices indicate that the market is betting GM will go down under in the next 2 years, even with a government subsidy. The article argues that in the current market, knowing government's plans is the only way to make money. If one doesn't then there is a very good possibility of losing money, irrespective of whether you are long or short.

This does not come as a surprise to people who follow the Indian markets. The Indian finance minister has many times reversed market sentiment just by calling a press conference!

The other is a post on a blog, in which one of the commenters had combined the news on Somali pirates with the news of Citigroup shares tumbling 46% in two days, to come up with this masterpiece:

The Somali pirates, renegade Somalis known for hijacking ships for ransom in the Gulf of Aden, are negotiating a purchase of Citigroup. The pirates would buy Citigroup with new debt and their existing cash stockpiles, earned most recently from hijacking numerous ships, including most recently a $200 million Saudi Arabian oil tanker. The Somali pirates are offering up to $0.10 per share for Citigroup, pirate spokesman Sugule Ali said earlier today. The negotiations have entered the final stage, Ali said. ``You may not like our price, but we are not in the business of paying for things. Be happy we are in the mood to offer the shareholders anything," said Ali.

The pirates will finance part of the purchase by selling new Pirate Ransom Backed Securities. The PRBS's are backed by the cash flows from future ransom payments from hijackings in the Gulf of Aden. Moody's and S&P have already issued their top investment grade ratings for the PRBS's. Head pirate, Ubu Kalid Shandu, said "we need a bank so that we have a place to keep all of our ransom money. Thankfully, the dislocations in the capital markets has allowed us to purchase Citigroup at an attractive valuation and to take advantage of TARP capital to grow the business even faster."

Shandu added, "We don't call ourselves pirates. We are coastguards and this will just allow us to guard our coasts better."

Tuesday, November 18, 2008

Credit Default Swaps in India?

In my post of April 8, 2007, I had argued about the need to enhance liquidity in the debt market. Credit derivatives are essential tools to mitigate risk and the introduction of the derivatives is a step in the right direction. However, introducing CDS alone will not be enough - credit derivatives market cannot be moved onshore unless India moves steadily towards full capital account convertibility.

Some people argue that India should never allow full capital account convertibility. In their defence, they cite the example of how some of the East Asian countries were battered during the crisis of 1997. The article by Easwar Prasad and Raghuram Rajan (link) offers a balanced perspective.

Tuesday, November 11, 2008

China's $600 bn stimulus package

We could not have been more prescient. The Chinese government has now declared a huge stimulus plan worth nearly USD 600 billion over the next 2 to 3 years on infrastructure build up. As always with China, there is not much information available on how the stimulus package will work and what part of it is in addition to the projects announced already.

There is no doubt that such a massive capex plan will ensure that demand in many basic industries do not fall off a cliff. However, one needs to guard against the build-up of non-productive assets, for which China is well-known.

The stock markets greeted the move with a big rally, but it will not be long before the rally peters out!

Saturday, October 25, 2008

'I made a mistake' admits Greenspan

Greenspan is viewed by many as an oracle-type personality, but I have had misgivings against him (against the Fed (of which he was chairman), to be precise) for the following reason:

During the 18 year period when Greenspan was at the helm, whenever a crisis arose, the Fed came to rescue by significantly lowering the Fed Funds rate, often resulting in a negative real yield. The Fed did so after the 1987 stock market crash, the LTCM debacle, and the Nasdaq bubble burst. The Fed's pattern of providing ample liquidity resulted in the investor perception of put protection on asset prices. The result - every time the Fed put was in action, the bubbles just shifted from one asset class to another and kept becoming bigger. I had warned that the Fed's action of cutting interest rates in 2007 would not solve the issue, but would just postpone it and in the process create additional bubbles. I was right - Fed's action did create a bubble in commodities and emerging market equities. These bubbles have burst now, creating havoc in the process.

Coming back to Greenspan, I am happy that he has now admitted that unbridled deregulation is bad for the markets. I agree that capitalism is good - it is indeed our best hope to create equitable and sustainable development and prosperity. However, capitalism needs to have conscience. Recent event prove that markets are incapable of self regulation.

Many people believe that it is not the job of the central bank to identify and deflate asset bubbles – I beg to differ. When asset bubbles get created and finally burst, they cause heavy damage to sections of the populace which had no role to play in creating the bubble. The recent financial meltdown shows very clearly that it is not just the speculators who get affected – crises do have an effect on the economy, on jobs, and on the livelihood of poor families.

Some people do argue that central banks do have very limited tools. The plight of the Reserve Bank of India (RBI) in managing the relentless capital inflows into the Indian equity and real estate markets last year is a case in point. The RBI had to soak up USD from the market, releasing Indian currency. This increased liquidity in the system and also pushed inflation upwards. To flight inflation, RBI had to increase benchmark interest rates – the increase in interest rates increased the interest rate differential and led to even higher dollar inflows. It was a vicious cycle.

The world has become so complex that unless there is coordinated action from most of the central banks, it will be difficult to craft an effective response. Many people think China should let its currency appreciate faster. Try telling that to Chinese authorities who need to ensure 10% GDP growth to keep the political system stable!

Monday, October 20, 2008

Funny metaphors

1. This is a dead cat bounce

2. The stock markets took of like a rocket and then nosedived like a failed rocket

3. We all learnt in school what goes up must come down

This is my favorite: “The train has left the station. There is no point in getting off now”

Sunday, October 19, 2008

Emerging market OR Submerging market? Ask FIIs

The Economic Times, the most widely read Indian business daily, carried an interesting article:

“Foreign institutional investors (FIIs) have played a major role in pushing up the index and pulling it down, hurting themselves in the process.

During the ride of the sensex from 10,082 points on February 7, 2006 to 20,582 points on January 10, 2008, FIIs had made a net purchase worth Rs 1,00,951 crore (close to 22 billion USD). During this period, the FIIs provided the required liquidity and the cues for others to follow.

FIIs' net off-loading was to the tune of Rs 47,299 crore (close to 11 billion USD), dragging down the sensex from 20,582 points to 9,975 points”

This clearly shows that FIIs could not make a clean and complete exit and have, along with Indian investors, burnt their fingers getting carried away by the euphoria caused by the Fed’s slashing of benchmark rate in September 2007.

Saturday, October 18, 2008

Where is the global economy headed?

There is so much panic, skepticism, and fear among not just investors but also laymen who are wondering whether they will get to keep their jobs, be able to feed their families and pay their mortgage. The scenario is so anti to how it has been over the last few years when words like optimism, confidence and euphoria defined the mood.

Not everyone has realized yet that the turmoil in credit markets will affect the real economy. The freeze in credit markets is bound to have a ripple effect on economic activity. People must be naïve if they think the credit crisis would affect only the financial markets. The crisis would push CEOs make preserving cash the objective, rather than chasing growth. Jeffrey Immelt, the Chairman & CEO of GE recently commented (not quoting him verbatim here) "for every dollar of economic activity, there is 10 dollars of financing involved in the entire supply chain. So if credit market freezes, economic output is bound to be affected."

Now back to the question - Where is the global economy headed?

A recent Reuters poll of economists showed that “the global economy will likely shudder to recessionary levels in 2009 as developed nations' woes damage emerging countries' economic prospects”. The IMF has also projected sharply lower growth for 2009. My take is that we should consider ourselves lucky if we can escape a deep and prolonged recession.

One bright spot in the economy right now is the fall in commodity prices. Oil prices have fallen 50% from the peak and prices of industrial commodities have crashed as well. Oil prices are likely to remain soft if OPEC does not become too greedy. Lower commodity prices will ease the pain many economies are facing.